For the investor, a too-high purchase price for the stock of an excellent company can undo the effects of a subsequent decade of favorable business developments. -Warren E. Buffett, Berkshire Hathaway Shareholder Letter, 1989

- Time for Celebration or Caution?

- What Do “High Valuations” Mean Anyway?

- Elevated Valuations Reflect Investor Optimism

- The Lurking Risks

- The Psychology of FOMO

- Are We In An AI Bubble Right Now?

- Final Thoughts

- Final Final Thought

Time for Celebration or Caution?

Stock markets are at record highs, with valuations stretched to levels rarely seen before. Depending on who you ask, this is either proof of unstoppable momentum or a bubble about to burst.

Investors face an acute dilemma: optimism from rising prices (and the ever-present fear of missing out) versus the need to protect hard-earned wealth from sharp declines. The balance between growth and safety depends on individual circumstances and appetite for risk.

When reviewing our portfolio, we should always remember: we don’t deal the cards, we just play the percentages.

What Do “High Valuations” Mean Anyway?

A market hitting a “record high” is not the same as it being “expensive.” Price tells us where the market stands – the aggregate opinion of millions of market participants.

In contrast, “valuation” tells you how much you are paying for a dollar of earnings. Common measures include:

Price/Earnings (P/E ratio)

A simple valuation multiple: the current stock price divided by earnings-per-share. P/E represents how much investors are willing to pay today, for each dollar of earnings. High P/E implies that investors expect high future earnings growth.

For example, the P/E of technology companies is generally much more than that for ‘boring’ firms like utilities. P/E can be applied to individual stocks or an index such as S&P 500.

Shiller PE / CAPE (Cyclically Adjusted Price-Earnings ratio)

Current price of the S&P 500 index, divided by the 10-year moving average of its inflation-adjusted earnings. Cyclically adjusting and smoothing data over a decade makes this useful for assessing extreme valuations – the likelihood of reversion to the mean - as well as inference of likely market returns in the years post observation.

Price-to-Sales

Useful in fast-growing industries where profits are less predictable, including stock of public companies not yet generating positive earnings (cost of doing business is more than revenue).

High valuations simply mean investors are paying more than usual, relative to underlying fundamentals. Sometimes that confidence is justified; sometimes it is not.

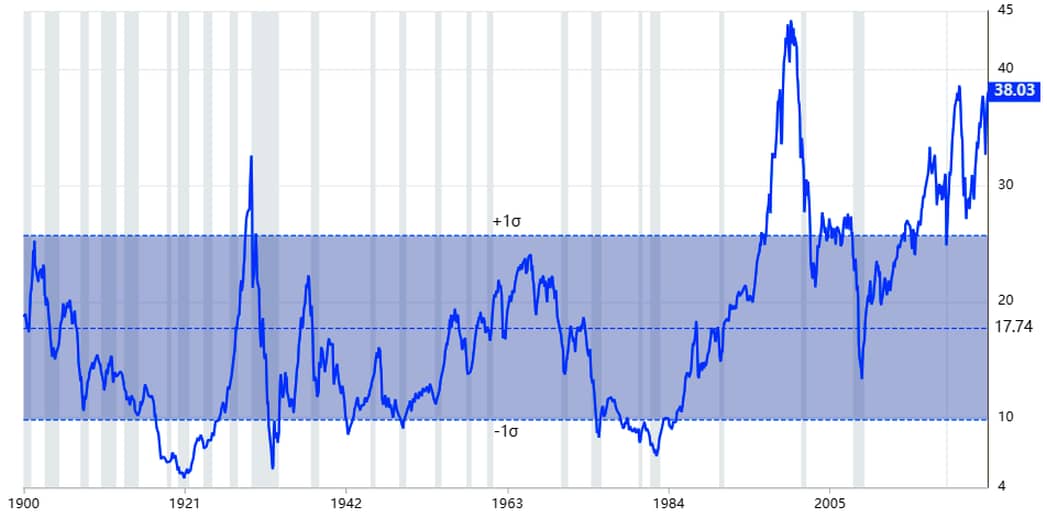

Shiller CAPE is a popular tool for assessing the overall market valuation in historical context, and current charts of CAPE are easily found online. Below is one such CAPE chart (source Gurufocus).

Chart: Shiller CAPE as at 2025-09-01

The average CAPE reading has been 17.74 since the start of the last century. The shaded area illustrates one standard deviation. Statistically, extreme current values indicate that sooner or later the CAPE will revert back towards the mean – typically a repricing event. As of 2025-09-01, CAPE is 38.03. Previous peaks are the pandemic, the dotcom boom, and the crash of the 1920’s.

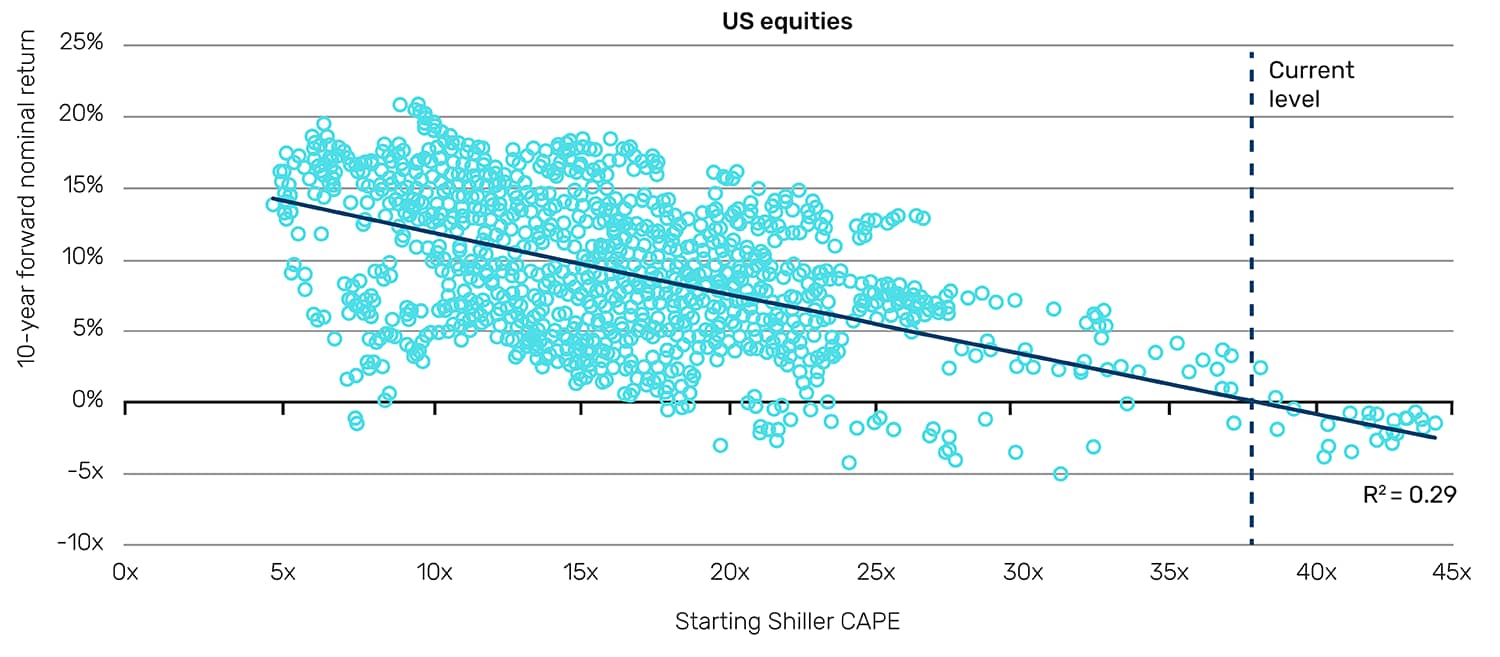

Because we have long-run data, we can compare CAPE levels with the 10-year returns that followed. The chart below, dated end of 2024, plots ‘Starting Shiller CAPE’ on the x-axis, versus future 10-year returns on the y-axis (source Man Group, notwithstanding the typo in their URL).

Chart: Shiller CAPE vs 10-Year Future Returns - US Equities - 1881 to 2024

Reading from the chart: if you take the best fit straight line through the data, current Shiller CAPE of around 38 suggests a future 10-year return of zero.

Elevated Valuations Reflect Investor Optimism

As I’ve discussed before (video), the stock market is not the economy. It’s an imperfect forecasting machine, driven by sentiment. Stock prices might rise because investors believe in strong earnings growth, technological innovation, or an economy cushioned by low interest rates.

But ultimately, prices rise because investors buy more stocks. That’s it.

There is also a ‘wealth effect’. As portfolios grow, households feel more secure and are likely to spend more, reinforcing the growth cycle.

History shows that many of these valuation peaks have coincided with transformative themes. The dotcom boom of the late 1990s reflected the promise of the internet. Today’s high valuations reflect excitement about artificial intelligence and digital transformation.

Excitement by investors, that is. Less so, perhaps, for ordinary folk worried about their employment prospects.

The Lurking Risks

Stretched valuations carry risks. As CAPE shows, the higher the starting valuation, the lower the long-term return.

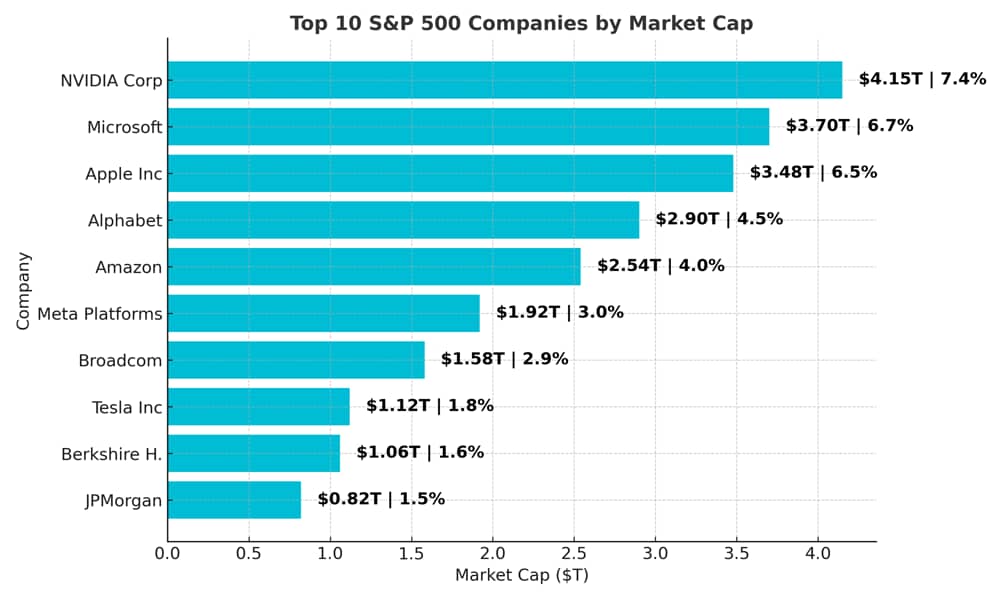

Concentration risk is often mentioned by financial media today. Much of today’s market strength comes from just a handful of technology giants – the so called Magnificent Seven (Apple, Microsoft, NVIDIA, Alphabet, Amazon, Meta, Tesla.). These seven companies account for about one-third of the entire S&P 500 market capitalisation. In calendar 2024, these firms delivered 55% of the S&P 500’s total returns, while the other 493 contributed justy 45%.

We might consider it a good thing to be weighted towards the winners when prices are rising. But it leaves us exposed to an outsized downside if the AI/tech sector slips.

Enthusiasm can turn to doubt almost overnight, as seen with Nvidia’s sudden correction earlier this year. On 27th January 2025, its stock plummeted 17% in a single trading session – wiping out $600 billion in market capitalisation - the largest single-day market value loss by any company in U.S. history.

Remember, concentration is the opposite of diversification.

In fact, the top 10 largest companies account for almost 40% of the S&P 500 index, and almost 17% of the entire global stock market capitalisation. Your market-cap weighted global stock index tracker may not be as diversified as you think.

Chart: Top 10 Companies by Market Cap and Share of S&P 500

Back to life, back to reality. Back to life, back to reality… Back to life, back to the present time. Back from a fantasy, yes. -Soul II Soul, 1989.

The Psychology of FOMO

For many investors, the greatest risk is not missing out - it’s chasing performance late in the cycle. Fear of missing out (FOMO) can drive investors into crowded trades just as the market nears its peak. Yet catching every last uptick matters far less than protecting capital during downturns.

Behavioural research shows that people feel pain of loss about twice as strongly as the pleasure of equivalent gains (Tversky & Kahneman’s Prospect Theory). FOMO can arise if we mentally equate “missing out” with a real loss.

In reality, the opposite view is healthier: a disciplined investor who resists FOMO not only avoids deeper losses in a correction but gains peace of mind knowing wealth is better protected.

What’s perhaps worse: studies show that FOMO can actually lead to increased risk-taking rather than loss avoidance.

Are We In An AI Bubble Right Now?

The signs of an AI-driven bubble are strong, though bubbles can last far longer than expected. Also, measures like the Shiller CAPE don’t give hard timing information. Odds of a decline might be high, but we can’t say when.

Elevated valuations do reflect innovation and optimism, but also raise the stakes - markets are more sensitive to shocks and more prone to reversals.

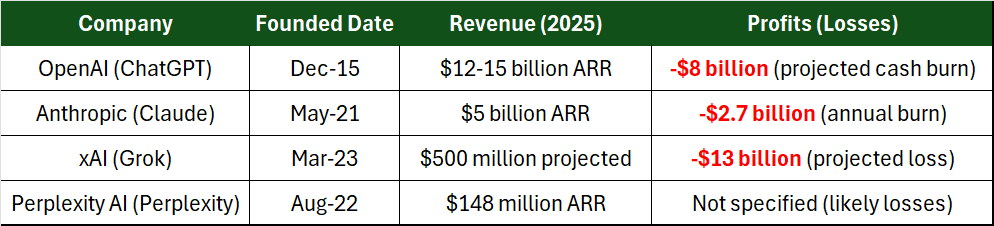

Take a guess how many AI LLMs are profitable right now? Very few. Here are some names you might recognise:

Chart: 2025 Profits (Losses) Projected for Well Known LLMs

Final Thoughts

Discipline, true diversification, and resisting FOMO remain the surest ways to protect and grow wealth across market cycles.

Think in time horizons, and recognize the difference between short-term market momentum and long-term wealth preservation.

Control emotions; a strategy that avoids panic-buying at peaks (or panic-selling in downturns) is more valuable than predicting the next move.

Final Final Thought

Did you know that Amazon, a survivor of the dotcom bust, is so old-fashioned it still has ‘.com’ in its official company name?